The major economies continue to battle against risk which could delay the recovery

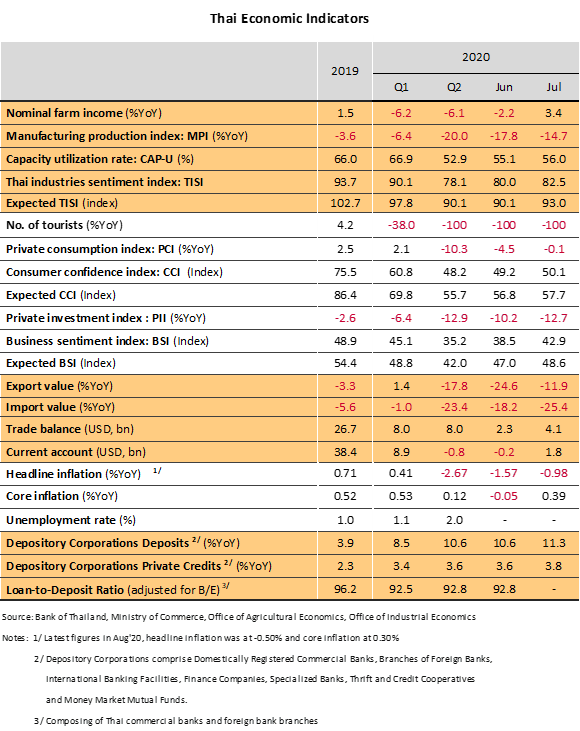

The US recovery may be losing momentum, underlining the need for further stimulus measures. August’s Composite PMI climbed for the 2nd month, reaching 54.7, while for the first time in 5 months, the ISM services PMI edged lower to hit 56.9, these signals pointing to the uncertainty of the recovery in services, which account for 77.4% of US GDP. Non-farm payrolls rose by 1.37 million in August, bringing the unemployment level down to 8.4%, the 5th month of falls, and hourly wages also picked up by 0.4% MoM but despite these positive signs, the continuing jobless claims remained high with a total of 13.3 million.

Krungsri Research foresees uncertainty surrounding the US recovery due to (i) a slowing rebound in the service sector and unemployment that remains high compared to the pre-COVID level of 3.5%, and (ii) delays in agreeing to the new round of fiscal stimulus packages that have been driven partly by concerns over mounting public debt, which as of 2Q20 had risen to 105.5% of GDP. This continuing weakness in the US recovery may now prompt the Fed to announce the use of further measures at its next meeting in mid-September.

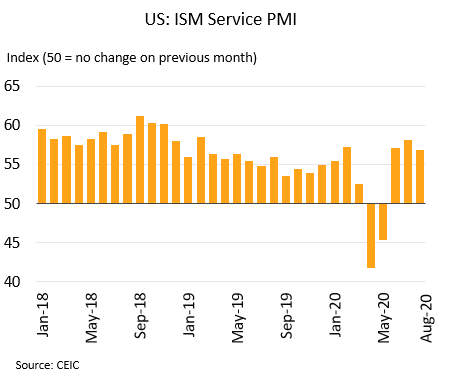

The Japanese economy has improved slightly but the new government policy should be monitored. July’s industrial output rose 8.0% MoM (the 2nd month of increases) on improvement in the auto and iron industries, although unemployment rate moved up slightly to 2.9%. However, the number of furloughed workers receiving government support has dropped to 3.1% from the April high of 9.6%, and the Composite PMI in August also strengthened for the 4th month, now standing at 45.2.

These figures reflect the sluggishness of the Japanese recovery, even though the official statistics do not yet reflect the easing of restrictions, which have been implemented to avoid the second wave of infections. At the same time, the new prime minister’s policies should be assessed. Recently, Yoshihide Suga, the Chief Cabinet Secretary, is likely to win and it is expected that he will continue his predecessor’s policies, which would tend to support continuing recovery.

China continues to recover on the strength of its service and construction sectors, and although profits are falling, Fitch has maintained its ratings for Chinese banks. August’s official Composite PMI rose for the 6th month to 54.5, driven by a better performance of non-manufacturing PMI, which hit a 30-month high of 55.2, though the manufacturing PMI recorded 51.0, just 0.1 points drop from last month.

The weakening of the manufacturing PMI is being offset by ongoing recovery in non-manufacturing industries, especially in services and construction, whose PMIs have reached their highest level since 2018. Indeed, in the case of construction, the PMI has now gone above 60.0 for the 2nd month on extensive government support for the infrastructure investment. Meanwhile, although 1H20 profits for the 4 largest Chinese banks worsened by some 10-12% YoY, Fitch has kept its assessment unchanged and views the Chinese banking sector as remaining ‘stable’, thanks to the moves by the PBOC to cut interest rates and to help debtors by deferring loan repayment, thus reducing Chinese banks exposure to financial risk.

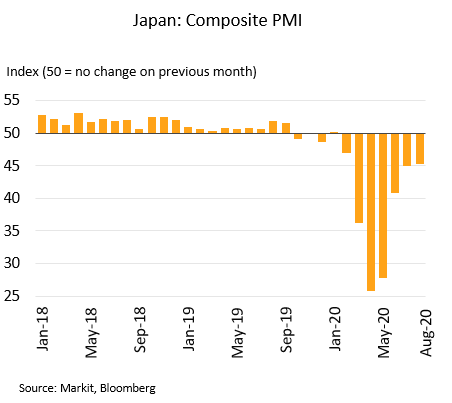

Economic activity and inflation are slowly picking up, but risks are mounting. Government support remains essential

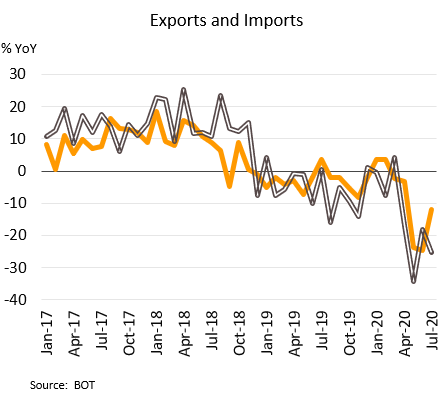

In July, the economy gradually climbed from the bottom. The government is also preparing the additional stimulus measures. Government spending remains the key driver of recovery and the July figures for private consumption fell by only -0.1% YoY, compared to -4.5% in June. This was partly due to (i) temporary factor from longer holidays than a year earlier to make up for the cancelled Songkran break, (ii) the easing of the lockdown and (iii) government policies to boost spending as well as domestic tourism. Declines in exports also slowed in July for almost all segments as trading partner economies gradually improved. However, private investment remains weak and fragile, as reflected in the -21.8% drop in the value of machinery distributed to the domestic market, the -21.2% fall in imports of capital goods, and the -16.7% decline in vehicle registrations, while for the 4th month running, there were no foreign tourist arrivals due to international travel restriction.

.png.aspx)

There are signs of a recovery at the start of 3Q20, but risks remain from a second wave of COVID-19 infections at home and abroad, together with domestic political uncertainty. It is also clear that a return to pre-COVID levels of foreign tourist arrivals is going to be a protracted process. Boosting economy from internal driver thus remained essential. Recently, the government is preparing its co-payment programs, which are (i) the THB 45bn new cash handout program, granting 50% subsidy of purchases with a cap of THB 3,000 per person for 15 million people, and (ii) the THB 23bn for employing new graduates, subsidizing 50% of the salaries up to THB 7,500/month for a one-year period.

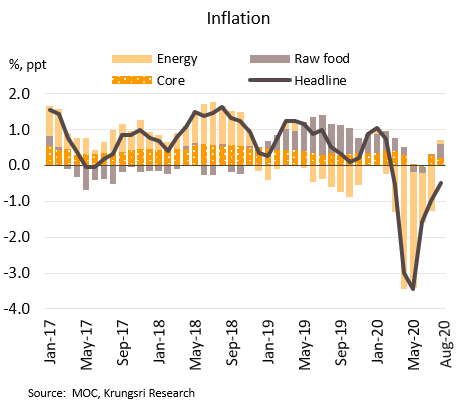

August’s inflation showed a continuing less negative for the third month, while the BOT is strengthening its non-interest rate policies. Headline inflation rose from -0.98% in July to -0.50% YoY in August on higher prices of food and non-alcoholic beverages (up 1.62%) caused by the impact of heavy rain which then drove the prices of fresh vegetables to hit a 13-month high. Meanwhile, prices of non-food and beverages fell for the 7th month, weakening by -1.73% on low global oil prices. Core inflation (excluding raw food and energy prices) dropped to 0.30% from 0.39% in July. For 8M20, average headline and core inflation stood at -1.03% and 0.33%, respectively.

The less negative inflation rate points to recovery, albeit slow, but the low and stable core inflation rate also underlines the weak domestic demand, while labor market fragility will suppress purchasing power and domestic spending in the next period.

At its last meeting, the MPC stated that “the level of overall liquidity in the financial system remains ample,” suggesting the need for broad-based monetary stimulus, including policy rate cuts, is less likely. Nonetheless, the BOT remained ready to deploy non-interest tools. At the end of August, the BOT put in place measures to help small borrowers through debt consolidation that will alleviate burden of interest rate payment. However, analysis by Krungsri Research shows that targeted direct loans to troubled firms who lack collateral are better than other means, such as interest rate or tax cuts, debt moratorium and revisions of lending criteria.