Economic fragility in the major economies would drag on recovery in the next period

The US labor market is facing the increase in permanent unemployment, while uncertainty over the next round of stimulus measures persists. The rate of new job openings jumped 4.5% in July, its highest rate since October 2019, but the number of initial jobless claims for w/e September 5 remained at 884,000, and the continuing jobless claims climbed to 13.4 million. August’s inflation also rose, hitting a 5-month high of 1.3%. Krungsri Research believes that the US economy is losing momentum. Although temporary unemployment is down, the number of workers who have permanently lost their jobs has now risen to 3.4 million, the highest level since 2014. Adding to this, uncertainty could arise from (i) legislative holdups continue to delay the next round of stimulus measures, most recently with the Senate voting down the Republican’s USD 1.3trn package, and (ii) President Trump aims to half payments for furloughed workers, cutting these to just USD 300/week, which possibly causes the negative consequences for income, expenditure and the recovery in the next period.

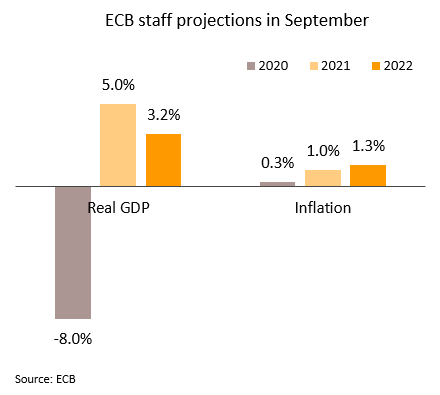

Against a background of rising risk, the ECB maintained its monetary policy stance. The European Central Bank (ECB) kept policy interest rates at its current level and left funding for the Pandemic Emergency Purchase Programme unchanged at EUR 1.35trn until June 2021, or until the COVID-19 crisis passes. In addition, the ECB now sees the -8.0% fall of Eurozone GDP in 2020, compared to June’s prediction of -8.7%, while the outlook for inflation is maintained 0.3% this year and revised up to 1.0% for next year

(previously 0.8%).

The ECB’s view of Eurozone prospects has improved slightly from previous projection and the bank is not rushing to further relax monetary policy in the near future, but the door remains open to this, given that: (i) the ECB has cut its forecast for 2021 GDP growth from 5.2% to 5.0%; (ii) the 2020-2022 inflation forecasts remain below 2% target; and (iii) the ECB has identified “downside” risks and “elevated uncertainty” over the economic situation, to which has now been added the surging possibility of a no-deal Brexit.

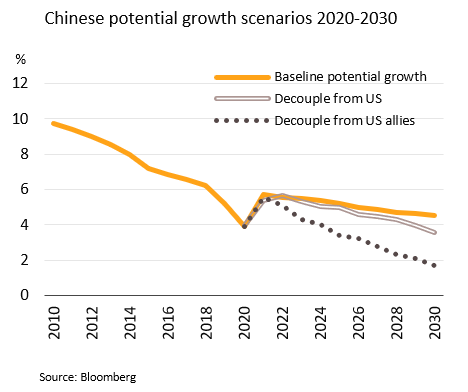

Chinese exports are performing better but rising tensions with the US may affect long-run potential growth. Exports jumped 9.5% YoY in August, improving from July’s figures and the 3rd month of increases. Exports of medical equipment were particularly strong, rising 46.1%, while exports of facemasks were up 33.4% for the past 8 months.

Although the Chinese exports are rebounding, relations with the US are increasingly strained, with the US now considering a ban on imports of cotton from Xinjiang in response to human rights abuses committed against the Uighurs population, while also demanding China’s ByteDance to sell its TikTok app to US buyer by themid-September. The long-running conflicts between these two countries have posed a long-term threat to the Chinese economy, and Bloomberg sees China’s potential growth dropping to 3.5% by 2030 if US trade, investment and technology transfers to China dry up.

Household consumption remains weak; Krungsri Research expected a rising risk of business liquidity shortage next year

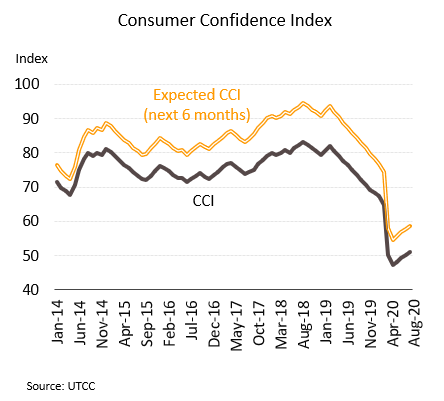

Consumer confidence improved in August but remains low, reflecting fragility of household spending. The Consumer Confidence Index (CCI) rose for the 4th month running in August, climbing from 50.1 in July to 51.0 on a resumption of business activities across much of the economy and the continuing issuance of alleviation and revitalization measures. However, in the view of Krungsri Research, despite the across-the-board improvements in consumer confidence, when compared to pre-COVID-19 levels, this remains very low. August’s CCI for the expectation in the next 6 months rose slightly as far as 58.7 (from July’s 57.7), indicating the tendency of slow recovery in household spending, amidconcerns over the slowness of the economic rebound due to rising downside risk and uncertainty over the possibility of a second wave of COVID-19, unemployment and domestic political instability. At the same time, the implementation of government stimulus measures to boost employment and lift domestic spending by making grants of THB 3,000 subsidy to 15 million people remains unclear and could lead to the discontinuity of recovery.

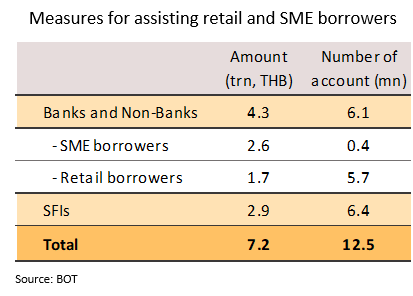

Krungsri Research’s latest forecast indicates that over 30% of businesses may encounter inadequate liquidity in 2021. The Bank of Thailand (BOT) has disclosed data on debt relief measures for retail and SMEs borrowers affected by COVID-19. As of July 31, 12.5 million accounts had received a total of THB 7.2trn in assistance, comprised of (i) THB 4.3trn, which has gone to 6.1 million accounts to commercial banks and non-banks, and (ii) THB 2.9trn, which has gone to 6.4 million accounts to government’s specialized financial institutions. This assistance has taken the form of debt moratorium, extending repayments schedules, cutting interest rates, and restructuring debts. Based on recent BOT’s assessment, most debtors will not need to request help through the end of temporary relief period (in October this year), and in the next period, the BOT will focus on supervising and resolving problems with each debtor individually.

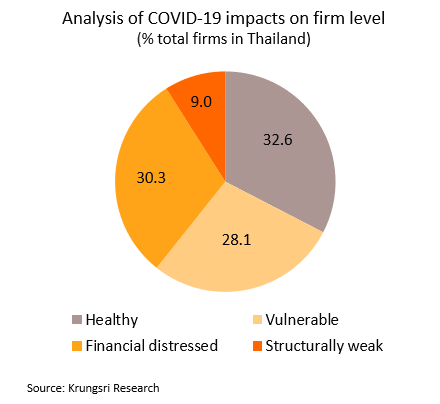

Although most assistance for troubled debtors, especially debt moratorium measures will come to an end in October, the ability of debtors to pick up their repayments is an area of concern, given the continuing rise in COVID-19 cases, the maintenance of social distancing and other preventative measures, which thus heavily impacts the global economy, especially the tourism industry and related areas. Moreover, the Thai economy is forecasted to contract sharply this year, and it is likely to take at least 3 years to return to its pre-COVID-19 state. These challenges will impact most of Thai businesses and industry through a range of channels over both the short and long term. The recent company-level analysis by Krungsri Research shows that in 2021, 143,414 firms (30.3% of the 473,324 total firms in Thailand) are expected to experience a shortage of liquidity, while a further 132,980 firms (28.1% of the total) will be vulnerable and likely expose liquidity risk, leaving just 32.6% (154,318 firms) that are considered to be financially healthy.