Both the OECD and the ADB see a protracted recovery; Fed signals to keep low interest rates longer, while BOE opens door for negative interest rates

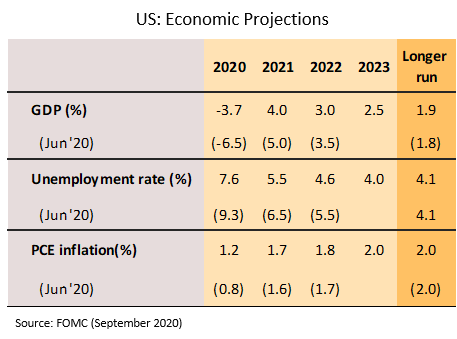

The Fed has revised its monetary policy framework, signaling that low interest rates may persist to 2023. The Fed has left policy rates unchanged, indicating that these are likely to remain low for at least the next 3 years, as well as revealing a new monetary policy framework that (i) implements average inflation targeting, which allows inflation to rise over 2% at times, and (ii) redefines maximum employment to be broad-based, particularly helping low-income groups. In addition, the Fed has revised its 2020 GPD growth forecast to -3.7%, relative to earlier projection of -6.5%.

Krungsri Research believes that the revision of the 2020 GDP forecast is driven by reopening of economic activity and pent-up demand following the relaxation of lockdowns, but the latest indicators show that the recovery is losing momentum. The August PMI has weakened, and industrial output dropped -7.7% YoY, worse than July’s figures, while initial jobless claims for w/e September 12th totaled 860,000, close to the figure for last week. These figures reflect that the next phase of recovery is likely more challenging. Forecasts for the next 3 years (2021-2023) also see GDP growth slowing relative to earlier predictions, with forecasts of 3.0% growth for 2022, and just 2.5% in 2023, indicating that any return to pre-pandemic conditions would take a longer time.

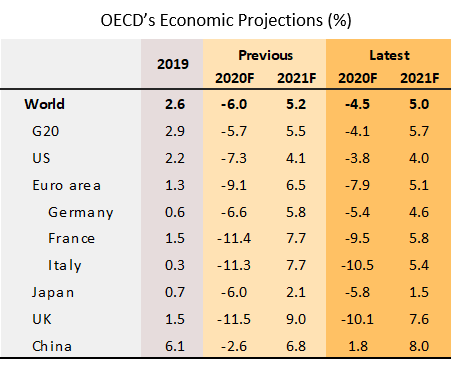

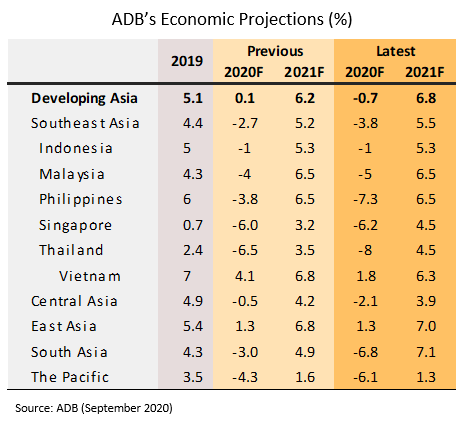

The OECD and the ADB both see the world economy facing a slow recovery, while China is not in a position to support global growth. The Organization of Economic Cooperation and Development (OECD) now revises the 2020 global GDP growth to -4.5%, compared to a previous projection of -6.0%, whereas the Asian Development Bank (ADB) now sees Asian GDP contracting by -0.7% (a downgrade of its prior forecast of 0.1% growth), the Thai economy shrinking by -8.0% and Chinese economy growing by 1.8%. Indeed, the latest indicators point to continuing improvements in China, with August retail sales rising 0.5% YoY (the first rise in 8 months) and industrial output increasing by 5.6% (the 5th month of improvements).

Although the OECD has upgraded its 2020 forecasts, the outlook remains negative and a slow, L-shaped recovery is still anticipated, while the ADB predicts the first Asian contraction in 60 years, with a return to normality is expected to be protracted. In the case of China, imports fell in August for the 2nd month, indicating the Chinese rebound is unlikely able to stimulate overall global economic recovery.

The BOE may implement negative interest rates to counter risks arising from a no-deal Brexit. The Bank of England (BOE) has left both its policy rates and funding for its GBP 745bn bond purchasing scheme unchanged. Meanwhile, the risk of no-deal Brexit is rising after the House of Commons passed the second reading of the Internal Market Bill, which could break the EU Withdrawal Agreement, and affect the EU-UK negotiations.

In the view of Krungsri Research, it is possible that the BOE may extend its quantitative easing (QE), given the considerable economic uncertainty that the country faces. The unemployment rate is expected to surge from 3.9% in July 2020 to 8.5% in April 2021, partly due to the ending of temporary help for the unemployed persons in October. Beyond this, the BOE has also indicated that it is ready to implement negative interest rates if the challenges posed by a no-deal Brexit make this necessary.

The government has agreed to short-term stimulus measures that should help support recovery in the last quarter of the year

Funding under stimulus measures worth THB 51bn will be gradually injected, starting by October. The government has recently agreed to 2 new projects to stimulate domestic spending: (i) an enhancement of purchasing power for 14 million government welfare card holders through additional THB 500 per person per month cash handout for spending on necessities over 3 months (October-December), worth THB 21bn; and (ii) a co-pay scheme, under which the government will subsidize 50% of the spending (to a maximum of THB 100 per person per day) for purchasing goods made from shops, stalls and street vendors, worth THB 30bn. This subsidy will be granted for 10 million people, which pays up to THB 3,000 per person between October 23rd and December 31th.

These abovementioned measures of THB 51bn are expected to promote domestic consumption and boost purchasing power of 24 million Thais, especially of low-income earners. Moreover, the government has just agreed to a THB 23bn program for employing new graduates. Positive impacts from these short-term measures could partly support the recovery. Krungsri Research anticipates that 11.8 million workers may see pay cuts or lose their jobs. Besides, there would be other headwinds arising from the continuously mounting number of global COVID-19 cases and the risk of political uncertainty domestically associated with demonstration.

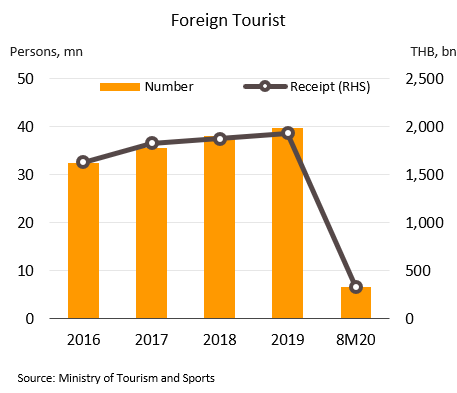

Permission for long-stay tourists will begin in October. At a September 15 meeting, the cabinet approved in principle to permit entry for visitors who have been issued a Special Tourist Visa (STV). This visa allows visitors to stay in the country for 90 days, and could then be extended twice, providing for a maximum stay of 270 days, starting from October.

This could be a positive sign for the tourism industry, but the impacts will be limited, given the authorities plan to admit only some 1,200 tourists per month, generating total monthly receipts of around THB 1bn, a small fraction relative to the pre-COVID level of 3 million monthly visitors and income of THB 150bn. Nevertheless, it could be monitored whether the program will be able to proceed as planned and whether an upsurge in domestic infections can be avoided.

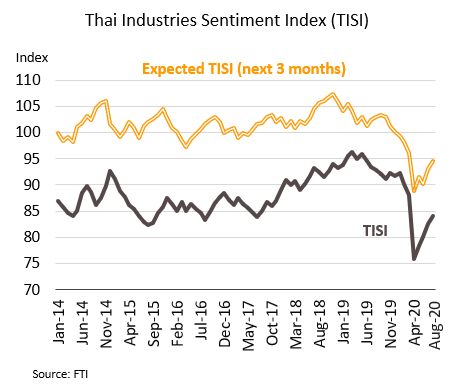

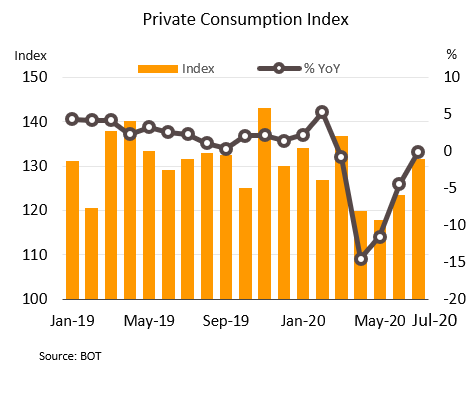

The Industrial Sentiment Index is rising. Krungsri Research estimates that Thai businesses would need THB 2.3trn to stay afloat. Thanks to the effective control of domestic transmission of COVID-19 and the relaxing of lockdown restrictions that allow economic activities return to normality, August’s Industrial Sentiment Index put in its 4th month of increases, rising from 82.5 to 84.0. Although the index is improving, it is still less than 100 and stay below pre-COVID level due to consumers’ fear over the fragility of the economy and subsequent caution over their spending. At the same time, SMEs are facing problems with liquidity and difficulty to access credit. The analysis by Krungsri Research shows that businesses will need an additional THB 2.3trn to repay debts within 2021, comprises of THB 0.6trn for large firms, THB 0.38trn for medium-size firms and THB 1.34trn for small-size firms, with problems being most severe for wholesale and retailers, food processers and auto dealers.